Are you tired of the inconvenience and frustration that comes with traditional banks? Delayed transfers, bad customer service, and long queues can be frustrating, to say the least. Luckily, Moneipoint is here to offer you a fast, secure, and user-friendly way to manage your financial transactions.

In this guide, I will take you through all the information you need to get started with Moneipoint, from opening an account to sending and receiving money, and even paying your bills. You’ll find everything you need to know to make your financial management easier, faster, and more efficient. So, let’s dive in and get started!

What is Moniepoint?

Moniepoint is more than just a digital bank, it is a lifestyle! It is a bank that understands the needs of the average Nigerian and has designed its services to cater to those needs. With Moniepoint, you don’t have to worry about long queues, delayed transactions, or bad customer service.

You can make all your transactions right from the comfort of your home or office.

Moniepoint is not just fast and reliable, it is also secure. You can be sure that your money is safe and secure when you make transactions with Moniepoint.

The platform uses the latest encryption technology to protect your transactions and keep your personal information safe.

With Moniepoint, you can send money to anyone, anywhere in Nigeria, pay bills, buy airtime and data, and even make withdrawals from any ATM. All these services are available to you 24/7, so you can make transactions at any time of the day or night.

Moniepoint is not just a digital bank, it is a revolution in banking in Nigeria. With Moniepoint, you have the power to take control of your finances and make transactions with ease. It is simple, fast, and reliable. So why wait? Sign up for Moniepoint today and start enjoying the freedom and convenience of digital banking.

Features Of Moniepoint

Below are some of the great features, which will make you fall in love with Moniepoint.

- Lightning-fast Transactions: With Moniepoint, you can say goodbye to long waiting periods for your transactions to be processed. Whether you’re sending or receiving money, Moniepoint’s platform guarantees speedy transactions.

- Wide Network Coverage: Moniepoint boasts of having one of the widest network coverages in Nigeria, making it easy for you to access their services wherever you are in the country.

- Competitive Exchange Rates: Moniepoint offers competitive exchange rates for foreign currency transactions, giving you the best value for your money.

- Secure Transactions: Moniepoint uses state-of-the-art security features to ensure that your transactions are safe and secure. You can rest easy knowing that your money is in good hands.

- User-Friendly Platform: Moniepoint’s platform is designed with the user in mind, making it easy for anyone to navigate and use. Whether you’re a tech-savvy individual or a novice, you’ll find Moniepoint’s platform easy to use and understand.

Moniepoint Signup and Registration: How to Create an Account with Moniepoint

Just like most digital banks, to open an account with Moniepoint, the first thing you will need to do is to download the app, on your mobile device, please note that the app is available for both IOS and Android users.

This means, you can either go to Playstore or apple store to download the app, all you have to do is to make use of the search icon to find the app on the store.

Also, have it in mind that the basic details will be required to open an account for you such as;

- Name

- Address

- BVN

- ID

- ETC

Now, that you know the basic requirements needed, I believe you must have gotten them nearby to you as we proceed to how you can open an account with Moniepoint.

Launch the app after you must have downloaded it, click on signup, and input the requested details.

After you must have done this, you will only be able to use your accounts after verifying them with your BVN and NIN otherwise, you will only be able to receive money with the accounts.

Hence, to avoid such limits, verify your account with the right details immediately.

How To Send Money With Moniepoint

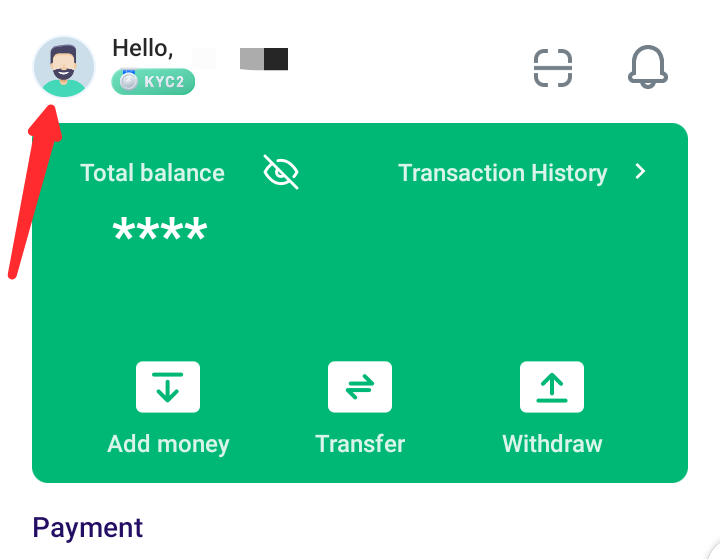

Sending money with Moniepoint is easy. To get started sending money, launch the app on your mobile device. On the interface, you will find several options, click on the option that has the label send money.

Once you have clicked on it, you will be asked to input the person’s details such as account number, and name. also, enter the amount you will like to send to the recipient and click on send.

Within 5 minutes, the recipient will receive the value amount sent.

How To Receive Money With Moniepoint

To receive money with Moniepoint, all you have to do is to give the person your account number. Once the money is sent, it will be automatically added to your balance.

How To Use Moniepoint For Payments

What else after the two we have listed above, you can as well use Moniepoint for payment of bills such as airtime, data, tv subscriptions, etc.

To do this, you will find the options on your app dashboard, just click on the one you will like to do, whether payments of bills, power supply etc, and you will get it done in a twinkle of an eye

Read Also: Canada Needs Skilled and Unskilled Workers: 4000+ Job Opportunities for Immigrants

FAQS

Below are frequently asked questions, which will provide answers to your other inquiries.

How do I accept payment on Moniepoint?

To accept payment on Moniepoint, you need to follow these simple steps:

- Register for a Moniepoint account and verify your details.

- Generate a payment link by logging into your Moniepoint account and clicking on “Payment Link.”

- Customize the payment link to include the amount and other details.

- Share the payment link with the person making the payment.

- Once the payment is made, the funds will be credited to your Moniepoint account, and you can withdraw them to your bank account.

How do I open a Moniepoint personal account?

To open a Moniepoint personal account, follow these steps:

- Visit the Moniepoint website or download the Moniepoint mobile app.

- Click on the “Create an account” button.

- Fill in your personal information, such as your name, phone number, and email address.

- Set up your password and security questions.

- Verify your phone number and email address.

- Complete the KYC (know your customer) process by providing your BVN (bank verification number) and other required details.

- Once your account is verified, you can start using your Moniepoint account to make transactions.

How much does Moniepoint charge per transaction?

Moniepoint charges a transaction fee of 0.5% for withdrawals between N1 and N20,000 on their POS. For transactions above N20,000, a flat rate of N100 is charged.

How much is the daily transaction limit for Moniepoint?

The daily transaction limit for Moniepoint varies depending on the type of transaction. The maximum cash withdrawal limit via Automated Teller Machine (ATM) is N100,000, subject to a maximum of N20,000 cash withdrawal per day.

Only denominations of N200 and below are loaded into the ATMs. The maximum withdrawal limit via point of sale (PoS) terminals is N20,000 daily. It is important to note that these limits may vary depending on the type and level of the Moniepoint account.

How much does Moniepoint charge for POS transfer?

Moniepoint charges 0.75% on POS transactions.

Conclusion

As we have seen, Moniepoint is packed with impressive features that set it apart from traditional banks. From its easy account setup process to its reliable customer support, Moniepoint delivers unparalleled convenience and efficiency to its users.

So why settle for outdated banking methods when you can embrace the future with Moniepoint? With this innovative digital bank by your side, managing your finances has never been easier or more enjoyable. Sign up today and experience the difference for yourself!