In recent months, there has been a rise in the use of fake transfers and payment alerts by scammers using Opay. These fake alerts are sent out to unsuspecting victims who are tricked into thinking they are getting money transferred to them.

Unfortunately, many people have fallen victim to these scams and have lost their hard-earned money. To help prevent yourself from falling victim to these scams, it’s important to know how to identify fake transfers and payment alerts and what steps to take to protect yourself. In this blog post, we will discuss how to spot fake transfers and payment alerts, as well as tips on how to stay safe and avoid becoming a victim.

Verify the Transaction

To protect yourself from falling victim to fake transfers and payment alerts, it’s crucial to verify every transaction before taking any action. Don’t simply rely on the alert itself; instead, independently confirm the transaction by logging into your Opay account or contacting your bank. This step ensures that you’re not being misled by scammers trying to deceive you. Take a few extra minutes to verify the transaction, and you’ll save yourself from potential financial loss and frustration. Remember, it’s better to be safe than sorry.

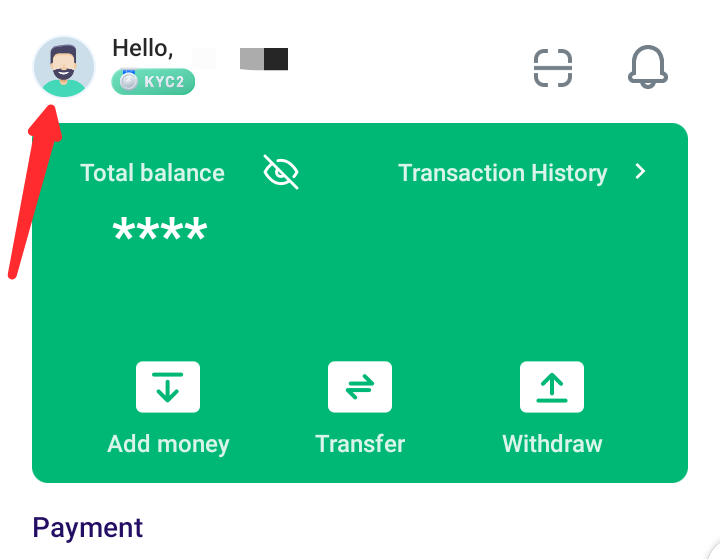

Check Account Balance

To ensure your safety when receiving transfer and payment alerts on Opay, it is crucial to regularly check your account balance. By doing so, you can verify if the funds have actually been deposited into your account.

Scammers often send fake alerts in the hopes that victims will not double-check their account balance and unknowingly provide sensitive information or complete fraudulent transactions. Taking a few moments to confirm the accuracy of your balance can protect you from falling victim to these scams and save you from potential financial loss. Stay vigilant and always verify before taking any further action.

Check the sender’s name

When you receive a transfer or payment alert on Opay, always take a moment to check the sender’s name. Scammers often use fake names or generic descriptions to disguise their true identity. If the sender’s name seems suspicious or doesn’t match the person or organization you’re expecting the transaction from, proceed with caution. Trust your instincts and don’t be afraid to reach out to the supposed sender to confirm the transaction. By being vigilant and verifying the sender’s name, you can protect yourself from falling victim to fraudulent activities and keep your hard-earned money safe.

Avoid Sharing Sensitive Information

Protecting your sensitive information is crucial when it comes to avoiding scams and fraudulent activities on Opay. Scammers often try to trick you into sharing personal details, such as your account login credentials or banking information. Never share this information with anyone, especially if you didn’t initiate the transaction. Opay will never ask for your sensitive information via email or text message. Be cautious and never provide any personal or financial information to unknown sources. By avoiding sharing sensitive information, you can safeguard yourself from falling victim to these scams and keep your finances secure. Stay vigilant and protect your personal data at all costs.

Beware of Urgency

Scammers often create a sense of urgency in their fake transfer and payment alerts to pressure you into taking immediate action. They may claim that there is a limited time to accept the transaction or threaten negative consequences if you don’t respond quickly. Beware of these tactics and always take a step back to evaluate the situation. Legitimate transactions rarely require immediate action, so if you feel rushed or pressured, it’s a red flag. Take your time, verify the transaction independently, and don’t let urgency cloud your judgment. Stay calm and cautious, and you’ll protect yourself from falling victim to these scams.

Read Also: Eagle Cash Loan App, Reviews, Interest Rates, App Download, Customer Service Number

FAQS

How does a fake debit alert look like?

A fake debit alert typically appears as a notification or message indicating that money has been transferred into your account. However, it may be fraudulent if the money doesn’t actually reflect in your account balance, or if you receive the alert from an unverified or suspicious source. To avoid falling victim to fake debit alerts, always verify transactions with the sender and check your account balance.

Can money be reversed on OPay?

Money transfers on OPay may not always be reversible. It depends on the circumstances and the specific transaction. If you’ve made an incorrect transfer or need to reverse a payment, you should contact OPay customer support immediately for assistance. They will guide you through the process and help determine if a reversal is possible.

Can dollars be sent to my OPay account?

OPay primarily operates in Nigerian Naira (NGN), so it may not support receiving or holding U.S. dollars directly in your OPay account. However, you can receive payments in other currencies, but they will be converted to NGN at the prevailing exchange rate. Contact OPay customer support for specific currency-related inquiries.

How do I transfer money from my OPay account to a USSD code?

- To transfer money from your OPay account to a USSD code, follow these general steps:

- Dial the USSD code of the recipient’s bank or mobile network (e.g., *123#).

- Select the option for transferring funds.

- Enter the recipient’s phone number or account details.

- Specify the amount you want to transfer.

- Confirm the transaction and follow any additional prompts.

- Funds will be deducted from your OPay account and transferred to the recipient’s account or mobile wallet.

What is the full meaning of OPay?

OPay stands for “Opera Pay.” It is a financial technology company and mobile payment platform that provides a range of services, including mobile money transfers, bill payments, airtime purchases, and more. OPay is a subsidiary of Opera Software, a well-known internet company.

Conclusion

In conclusion, it’s crucial to stay vigilant and protect yourself from fake transfer and payment alerts on Opay. By following the steps outlined in this blog post, such as verifying transactions, checking account balances, and being cautious with sharing sensitive information, you can greatly reduce your risk of falling victim to these scams. Remember, scammers are constantly coming up with new tactics, so it’s important to stay informed and be proactive in protecting your hard-earned money. By staying safe and taking the necessary precautions, you can enjoy the convenience and benefits of using Opay without the fear of falling for fraudulent activities.