The Bank Verification Number (BVN) is a unique 11-digit number that is used to identify and verify individual bank accounts. The BVN system was introduced by the Central Bank of Nigeria (CBN) in 2014 in an effort to reduce fraud and improve the security of the Nigerian banking system.

While the BVN system has been successful in reducing fraud, it has also made it more difficult for people who do not have a BVN to access financial services. This includes the ability to open bank accounts, receive money, and make payments.

In this article, we will discuss how much money you can receive without a BVN from four popular mobile money platforms in Nigeria: PalmPay, Opay, Kuda Bank, and MoniePoint.

How Much Can PalmPay Receive Without BVN in Nigeria?

Without a BVN, you can receive up to 300,000 Naira into your PalmPay account.

This means that any amount beyond 300k cannot be withdrawn, so it’s important to keep that limit in mind.

Having a BVN allows you to enjoy the full range of services provided by PalmPay and other financial institutions in Nigeria. It provides an extra layer of security and helps in preventing fraudulent activities.

Remember, while you can receive up to 300k without a BVN, it’s always recommended to complete your BVN registration to fully unlock the potential of your PalmPay account and enjoy seamless transactions without any limitations.

How Much Can Opay Receive Without BVN in Nigeria?

Without a BVN, you can not receive more than NGN 50,000 into your Opay account. This limit ensures that your transactions remain within a certain threshold for security purposes. It’s important to note that having a BVN unlocks more features and benefits on the Opay platform, so it’s recommended to complete your BVN registration for a seamless experience.

With Opay, you can enjoy convenient services such as money transfers, bill payments, and airtime purchases. So, even though there’s a limit without a BVN, Opay still provides you with a range of options to manage your finances easily and securely.

How Much Can Kuda Receive Without BVN in Nigeria?

With Kuda, you can receive up to NGN 300,000 without having a BVN. This means that any amount beyond that limit cannot be deposited into your Kuda account. However, it’s important to note that having a BVN unlocks additional features and benefits on the Kuda platform, so it’s highly recommended to complete your BVN registration to fully maximize the potential of your Kuda account.

With Kuda, you can enjoy convenient and secure services such as money transfers, bill payments, and more. So, while there is a limit without a BVN, Kuda still provides you with a range of options to manage your finances easily and effectively.

How To Add BVN To Your Palmpay, Kuda Or Opay Account?

Adding your BVN (Bank Verification Number) to your PalmPay, Kuda, or Opay account is a straightforward process that can be completed in just a few steps. Here’s how to do it:

- Download and open the PalmPay, Kuda, or Opay mobile app on your device.

- Navigate to the settings or account section of the app.

- Look for an option that says “Add BVN” or something similar.

- Click on the “Add BVN” option and follow the on-screen instructions.

- You will be prompted to enter your BVN, so make sure you have it handy.

- Once you have entered your BVN, click on the “Submit” or “Save” button.

- Your BVN will be verified, and once the verification process is complete, you will receive a confirmation message.

It’s important to note that adding your BVN to your PalmPay, Kuda, or Opay account is crucial for unlocking additional features and benefits. It provides an extra layer of security and helps in preventing fraudulent activities. So, take a few minutes to add your BVN and enjoy a seamless and secure experience with these mobile payment platforms.

FAQS

Is BVN required for PalmPay?

Yes, a BVN (Bank Verification Number) is typically required to register and use PalmPay. The BVN is a standard identification requirement for many financial services in Nigeria.

How much can a PalmPay account receive?

The maximum amount a PalmPay account can receive may vary, and it’s subject to the specific terms and conditions of PalmPay. The limit may depend on factors such as your account type and activity.

Does Kuda Bank use BVN?

Yes, Kuda Bank, like many other financial institutions in Nigeria, uses BVN as part of its customer identification and verification process.

Which bank can I open without a BVN?

In Nigeria, it’s generally challenging to open a bank account without a BVN. Most banks require a BVN for customer identification and to comply with regulatory requirements.

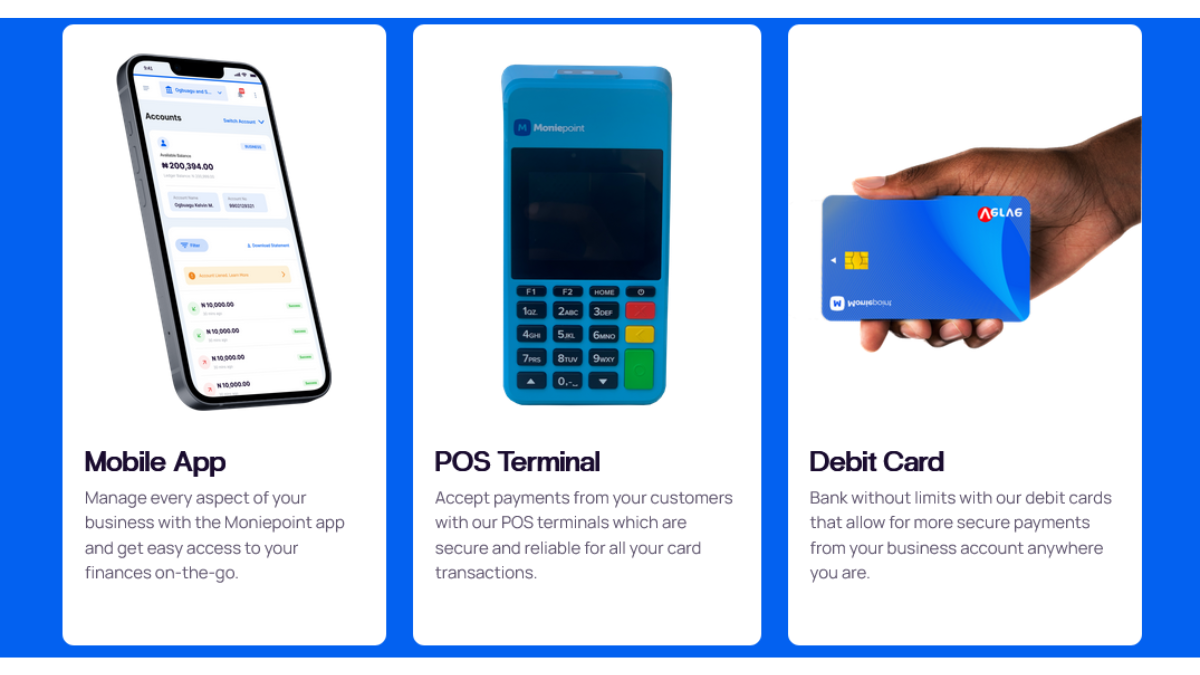

Can I use Moniepoint without BVN?

Moniepoint, being a financial service provider, is likely to require a BVN for certain transactions or account registration. BVN is a standard identification requirement in the Nigerian financial sector.

Read Also: How to Block First Bank Account and ATM Card Using USSD Code on any Phone

Conclusion

In conclusion, it’s clear that having a BVN (Bank Verification Number) is essential if you want to fully unlock the potential of your PalmPay, Opay, Kuda Bank, or MoniePoint account in Nigeria. While there are limits to how much you can receive without a BVN, it’s always recommended to complete your BVN registration to enjoy seamless transactions and access additional features and benefits on these mobile payment platforms.

Adding your BVN is a simple process that can be done through the mobile app of each platform. By doing so, you not only enhance the security of your account but also help in preventing fraudulent activities.

With a BVN, you can receive higher amounts, have access to a wider range of services, and enjoy peace of mind knowing that your financial transactions are secure. So, take a few minutes to add your BVN and make the most of your PalmPay, Opay, Kuda Bank, or MoniePoint account in Nigeria.