If you’re a fan of digital banking, you’ve probably heard of the two popular fintech companies Kuda and Opay. Both offer instant transfers, excellent customer service, and a range of impressive features. However, as with any organization, there are always pros and cons to consider.

As someone who has personally used both Kuda and Opay, I can confidently guide you through their features and help you make an informed decision on which one is best for you. I understand the importance of having a reliable and efficient digital banking platform, and I have thoroughly tested both services to provide you with accurate insights.

This is why I will be comparing these two digital banks so you can make informed decisions on which of them is better.

About Kuda

Kuda Bank is a digital bank that provides financial services to individuals and small businesses in Nigeria. The bank was founded in 2019 by Babs Ogundeyi and Musty Mustapha, with the aim of offering affordable, accessible, and convenient banking services to Nigerians.

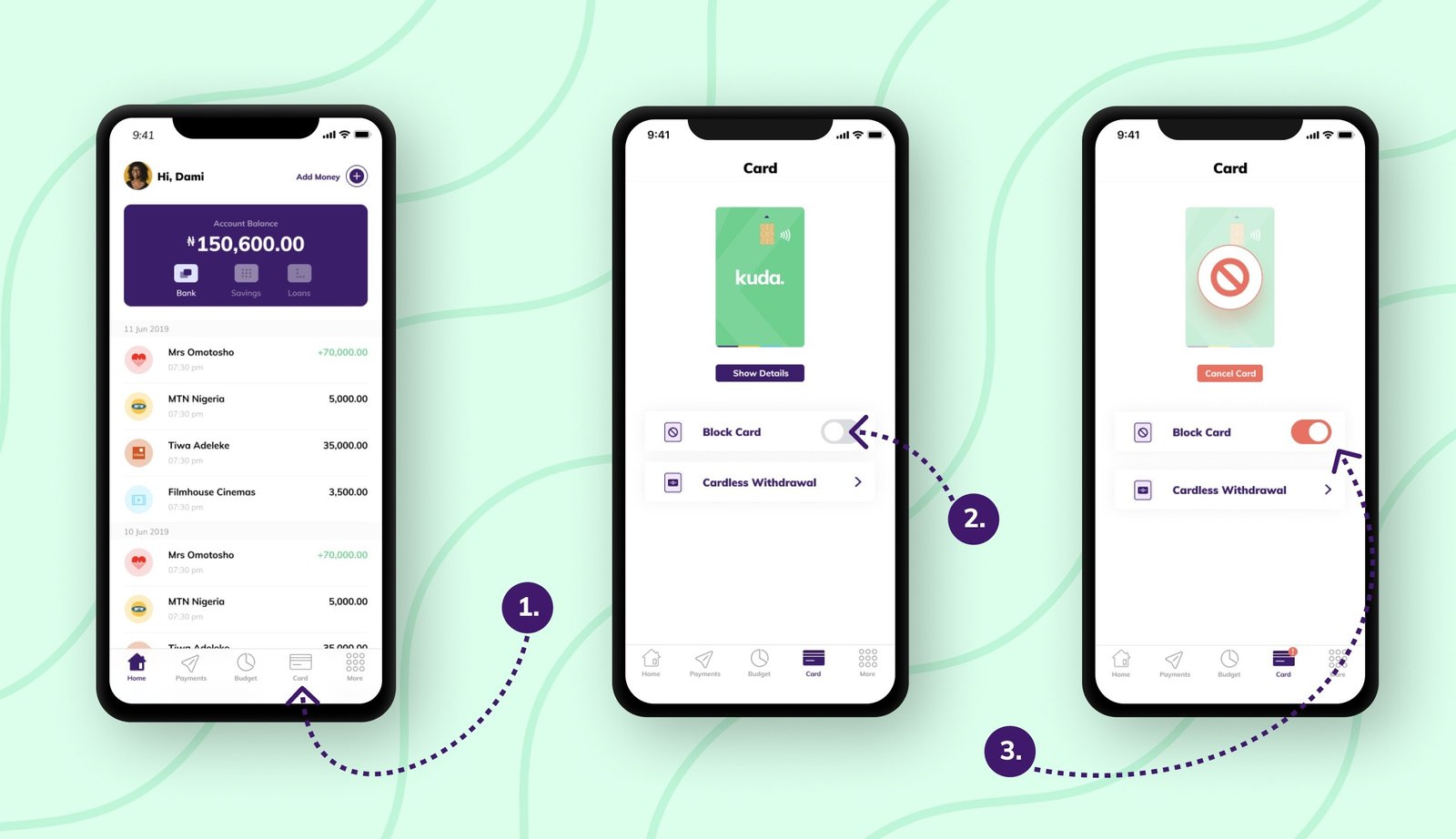

Kuda Bank operates solely through its mobile app, which is available for both Android and iOS devices. Customers can easily open an account within minutes, without the need to visit a physical branch or provide any paperwork. All that is required is a valid ID and a few personal details.

Kuda Bank offers a range of services, including savings and current accounts, bill payments, fund transfers, and loans. Customers can make transactions in real-time, and they receive instant notifications for every transaction. The bank’s app also provides tools for budgeting, savings, and financial planning, making it easy for customers to manage their money.

Read Also: Migrate To Canada: 5 Easy Ways To Get Canada Travel Visa

One of the unique features of Kuda Bank is its zero fees policy. The bank does not charge any fees for transactions, including ATM withdrawals, fund transfers, and bill payments. This makes Kuda Bank an affordable option for many Nigerians who have been burdened with high banking charges in the past.

Kuda Bank has been making waves in the Nigerian fintech space since its launch, and it has been able to attract a significant number of customers in a short period of time. The bank raised $10 million in a seed funding round in November 2020, and it has been expanding its services since then.

Features And Downside Kuda Bank

Kuda Bank is a digital bank in Nigeria that offers a range of features and benefits to its customers. However, like any other fintech company, there are also some potential downsides to using the bank. Here are some of the features and downsides of Kuda Bank:

Features:

- Zero fees: Kuda Bank offers a zero-fee banking service, which means that there are no charges for ATM withdrawals, transfers, and other transactions. This makes it a cost-effective option for individuals and small businesses.

- Easy account opening: With Kuda Bank, customers can open an account in minutes through the mobile app. The account opening process does not require any paperwork or visits to a physical branch.

- Instant notifications: Kuda Bank provides real-time notifications for every transaction, ensuring that customers are always aware of their account balance and transaction history.

- Budgeting and savings tools: Kuda Bank offers tools to help customers budget, save money, and plan for their financial goals.

- Loans: Kuda Bank provides loans to customers based on their creditworthiness and account history.

- Security: Kuda Bank employs industry-standard security measures to protect its customers’ data and transactions.

Downsides:

- Limited services: Kuda Bank does not offer all the services that traditional banks provide, such as credit cards, foreign exchange, and investment products.

- Availability: Kuda Bank is currently only available in Nigeria, which limits its accessibility to customers outside the country.

- Technology barriers: Kuda Bank relies on mobile technology, which means that customers who do not have access to smartphones or the internet may not be able to use its services.

- Deposit limits: Kuda Bank has a deposit limit of N300,000 ($733) per transaction, which may be inconvenient for customers who need to make larger transactions.

- Relatively new: Kuda Bank is a relatively new player in the Nigerian fintech space, and as such, it may be perceived as less trustworthy than established banks.

About Opay

Opay is a fintech company based in Nigeria that provides digital payment and financial services to individuals and businesses. The company was founded in 2018 by Opera Software, a Norwegian internet company that is best known for its web browser, Opera. Opay was launched as part of Opera’s strategy to expand its presence in Africa, where it saw a huge potential for growth in the fintech industry.

Opay’s main focus is on digital payments, and it offers a range of services to facilitate this, including mobile money transfers, bill payments, and e-commerce transactions. The company operates through a mobile app, which is available for both Android and iOS devices. The app provides a simple and convenient way for customers to make transactions, with real-time notifications and a user-friendly interface.

One of Opay’s unique features is its ability to integrate with other services, such as ride-hailing and food delivery apps. This means that customers can make payments for these services directly through the Opay app, without the need for cash or other payment methods. This has helped to make Opay a popular choice among Nigerians who are looking for a fast and convenient way to make payments.

Opay has also expanded its services beyond digital payments, and it now offers other financial products, such as savings accounts, loans, and insurance. These services are designed to meet the needs of individuals and small businesses, and they are accessible through the Opay app.

In addition to its payment and financial services, Opay has also launched a number of other initiatives to support entrepreneurship and economic development in Nigeria. For example, the company has launched a loan program for small businesses, and it has partnered with local farmers to improve their access to markets and financing.

Features And Downsides Of Opay

While the company has a range of features and benefits, there are also potential downsides that should be considered. Here are some of the features and downsides of Opay:

Features:

- Digital payments: Opay provides a convenient and secure way for customers to make digital payments, including mobile money transfers, bill payments, and e-commerce transactions.

- App integration: Opay can be integrated with other apps, such as ride-hailing and food delivery services, making it easy for customers to make payments for these services directly through the Opay app.

- Financial products: Opay offers a range of financial products, including savings accounts, loans, and insurance, to meet the needs of individuals and small businesses.

- Convenience: The Opay app is user-friendly and provides real-time notifications, making it easy for customers to manage their finances on the go.

- Entrepreneurship support: Opay has launched several initiatives to support entrepreneurship and economic development in Nigeria, such as loan programs for small businesses and partnerships with local farmers.

Downsides:

- Limited availability: Opay is currently only available in Nigeria, which limits its accessibility to customers outside the country.

- Network issues: Opay’s digital payments can sometimes be affected by network issues, which can result in delayed or failed transactions.

- Competition: The Nigerian fintech industry is highly competitive, and Opay faces stiff competition from other players in the market.

- Regulatory hurdles: Fintech companies in Nigeria are subject to regulatory oversight, which can pose challenges for companies like Opay.

- Trust issues: Some customers may be hesitant to use digital payment services like Opay due to concerns about security and fraud.

Kuda vs Opay: Which Is Better?

Based on these factors we have discussed above, the answer to the Kuda vs Opay debate ultimately depends on your specific needs and preferences. If you are looking for a comprehensive financial services provider with a wide range of offerings, Opay may be the better choice. However, if you are primarily interested in traditional banking services, such as zero-fee banking and loans, Kuda may be the better option.

FAQS

Which app is better than OPay?

In Nigeria, there are several digital payment apps that offer a range of features and benefits similar to OPay, such as Paga, Flutterwave, and Paystack. However, the choice of app ultimately depends on the individual’s needs and preferences, such as the range of services offered, user interface, and fees and charges.

What bank is better than Kuda?

While Kuda Bank has a range of digital banking services that make it a popular choice among Nigerians, there are many other banks in Nigeria that also offer digital banking services. Some options to consider include GTBank, Zenith Bank, and Access Bank. However, the choice of bank ultimately depends on the individual’s preferences and needs, such as the range of services offered, user experience, and fees and charges.

Which is better Palmpay or Kuda?

Both Palmpay and Kuda offer digital payment and financial services to customers in Nigeria, but the choice of app ultimately depends on the individual’s preferences and needs. Some factors to consider may include the range of services offered, the fees and charges, and the user interface. For instance, Palmpay has a wider range of services, including e-commerce and airtime top-up, while Kuda offers a more streamlined approach to banking.

Is it advisable to use Kuda Bank?

Kuda Bank is a popular choice among Nigerians for its range of digital banking services, such as mobile money transfers, savings accounts, and loans. However, like any financial service, it is important to consider the pros and cons carefully before deciding whether to use Kuda Bank. Some factors to consider may include the fees and charges, the range of services offered, and the user experience.

How reliable is OPay?

OPay is generally considered reliable for its digital payment and financial services in Nigeria

Conclusion

In conclusion, both Kuda and Opay are innovative fintech companies that are changing the financial landscape in Nigeria. While Kuda is primarily focused on providing traditional banking services with a modern twist, Opay offers a wider range of financial services and has plans to expand into other African countries.

When comparing Kuda and Opay, it is important to consider factors such as features, availability, usability, security, reputation, and customer service. Depending on your specific needs and preferences, one service may be a better fit than the other.

Ultimately, the decision on whether to use Kuda or Opay will depend on your individual financial goals and priorities. Both companies have their strengths and weaknesses, and it is important to conduct thorough research and consider all the relevant factors before making a decision.