Having a reliable and efficient payment solution is crucial for success. PayForce POS emerges as a game-changing tool, offering businesses a convenient and secure way to accept card payments from their customers. With its advanced features and user-friendly interface, PayForce POS is revolutionizing the way transactions are conducted.

This comprehensive guide explores everything you need to know about PayForce POS, including its charges, daily limits, pricing, customer care number, and office address. Whether you are a small business owner, a merchant, or an entrepreneur, this information will help you make an informed decision and leverage the power of PayForce POS to streamline your payment processes.

Discover the features and benefits of PayForce POS, understand the pricing structure, and learn about the daily limits that ensure smooth transactions for your business. Furthermore, gain insights into the customer care support offered by PayForce, ensuring that you have access to assistance whenever you need it. Finally, find out the location of their office, making it easier for you to reach out for any inquiries or support you may require.

Join the ranks of successful businesses that have embraced PayForce POS and witness the transformative impact it can have on your payment ecosystem. Say goodbye to the limitations of traditional payment methods and embrace the future of seamless transactions with PayForce POS.

How To Get PayForce POS

Whether you run a small retail store, a restaurant, or a service-based business, having a reliable point-of-sale (POS) system is essential for smooth transactions and enhanced customer experience. In this comprehensive guide, we will walk you through the process of getting PayForce POS and how it can benefit your business.

- Contact PayForce Sales Team: Once you have familiarized yourself with PayForce POS, reach out to the PayForce sales team to initiate the process of acquiring the POS system. You can contact them via phone, email, or by visiting their website. The sales team will provide you with detailed information on pricing, installation, and any specific requirements for your business.

- Provide Business Details: During the application process, you will be required to provide relevant business details, such as your business name, contact information, nature of business, and location. This information helps PayForce customize the POS system according to your specific needs.

- Agree on Pricing and Terms: The PayForce sales team will discuss pricing plans, transaction fees, and any additional charges associated with the PayForce POS system. It’s important to understand the pricing structure and terms of service before finalizing your agreement.

- Schedule Installation and Setup: Once you have agreed on the pricing and terms, the PayForce team will schedule the installation of the POS system at your business premises. A qualified technician will come to your location to set up the hardware, configure the software, and ensure that the POS system is fully functional.

- Staff Training: To maximize the benefits of PayForce POS, it’s crucial to provide training to your staff members who will be using the system. PayForce may offer training sessions or provide instructional materials to help your employees understand how to operate the POS system effectively.

- Start Accepting Payments: Once the PayForce POS system is installed and your staff is trained, you can start accepting payments from your customers. The POS system allows you to process card payments swiftly and securely, providing a seamless experience for both you and your customers.

- Ongoing Support: PayForce offers customer support services to address any technical issues or queries that may arise during the usage of the POS system. They have a dedicated customer care team that can be reached through phone, email, or their website.

By following these steps, you can acquire and set up PayForce POS, empowering your business with a robust payment solution.

PayForce POS Charges

PayForce POS charges are determined by the pricing plans and fee structures offered by the service provider. While the specific charges may vary, here are some common types of charges associated with PayForce POS:

- Withdrawals:

-

-

- For withdrawal amounts between N1 and N5,000, a fixed fee of N30 is charged.

- For withdrawal amounts between N5,001 and N16,500, a fee of 0.6% of the transaction amount is charged.

- For withdrawal amounts between N16,501 and N100,000, a fixed fee of N110 is charged.

- For withdrawal amounts above N100,000, a fee of 0.11% of the transaction amount is charged.

-

- Deposits:

-

-

- A flat fee of N25 is charged for deposits made through the PayForce POS.

-

- Airtime Top-Up:

-

-

- When you perform airtime top-up transactions using the PayForce POS, a fee of 2.5% of the transaction amount is charged.

-

- Bill Payments:

-

- The charges for bill payments through the PayForce POS vary and depend on the specific biller or service provider. The fee structure for bill payments is determined by the individual biller.

- Other Transactions:

- The charges for other types of transactions made through the PayForce POS may vary depending on the nature of the transaction. The specific fees will be determined by the type of transaction being performed.

PayForce POS Daily Limit

The PayForce POS daily limit for transactions is set at NGN1 million. This means that you can withdraw or transact up to NGN1 million in a single day using your PayForce POS terminal. It’s important to note that this daily limit may vary based on factors such as your account type and relationship with PayForce. If you are a high-value customer, you may have the opportunity to request a higher daily limit.

To determine your specific daily limit or to inquire about a potential increase, you have a couple of options. Firstly, you can log into your PayForce account and navigate to the settings or account details section to find information regarding your daily limit. Alternatively, you can reach out to PayForce customer support. They will be able to provide you with accurate and up-to-date details regarding your daily limit and guide you through the process of requesting an increase if applicable.

It’s important to keep in mind that the daily limit applies to various types of transactions, including withdrawals, deposits, airtime top-ups, bill payments, and other transactions facilitated through your PayForce POS terminal. If you attempt to exceed your daily limit, the transaction will be declined.

If you require a higher daily limit due to specific business needs or transaction requirements, you can contact PayForce customer support and discuss your situation with them. They will assess your request and provide guidance on the steps to take to potentially obtain a higher daily limit.

Remember to stay informed about your daily limit and ensure that your transactions stay within the prescribed limit to avoid any inconveniences or transaction rejections.

Read Also: How to get a Loan from Fidelity Bank in Nigeria in 6 easy steps

PayForce POS Customer Care Number

For any inquiries, assistance, or support regarding PayForce POS, you can easily reach out to their customer care team. PayForce’s customer care phone number is 07000102030, and you can connect with them via phone call or send a message on WhatsApp using the same number.

Whether you have questions about the PayForce POS device, transactions, account-related matters, or any other concerns, the dedicated customer care team is available to provide you with the necessary support and guidance. Simply dial the provided phone number or send a message on WhatsApp to initiate contact with PayForce’s customer care.

PayForce POS Office Address

PayForce is located at:

No. 15 Saka Tinubu Street, Victoria Island, Lagos, Nigeria.

You can visit their office during working hours for any inquiries, device pickup, or to discuss business partnerships. It is advisable to contact PayForce customer care beforehand to confirm their office hours and availability.

Features and Benefits of PayForce POS

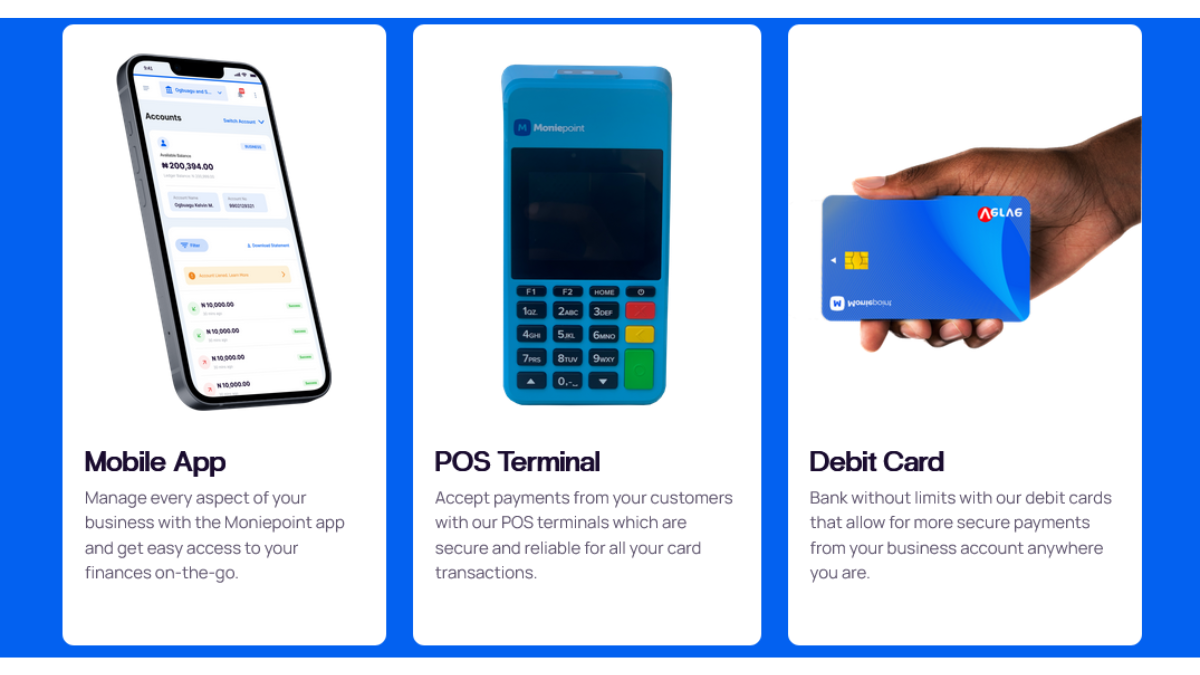

PayForce POS offers a range of features and benefits that make it a convenient and reliable payment solution. Here are some of the key features and benefits of using PayForce POS:

- Accepts multiple payment methods: PayForce POS allows you to accept various payment methods, including debit cards, credit cards, and mobile wallets. This enables you to cater to a wide range of customers and provide them with flexible payment options.

- Seamless transactions: PayForce POS ensures fast and hassle-free transactions, allowing you to serve customers efficiently. With quick payment processing, customers can complete their transactions swiftly, reducing waiting time and improving overall customer satisfaction.

- Enhanced security: PayForce POS prioritizes the security of transactions. It utilizes advanced encryption and security measures to protect sensitive customer data, reducing the risk of fraud or data breaches. This provides peace of mind to both you and your customers during payment transactions.

- Real-time transaction tracking: PayForce POS offers real-time transaction monitoring, allowing you to track sales and monitor transaction activities. This helps you stay informed about your business’s performance and make data-driven decisions.

- Detailed transaction reports: With PayForce POS, you can generate comprehensive transaction reports. These reports provide insights into your sales, transaction volumes, and other relevant data, enabling you to analyze your business’s performance and identify areas for improvement.

- Inventory management: Some PayForce POS solutions provide inventory management features, allowing you to track and manage your stock levels. This helps you maintain accurate inventory records, streamline operations, and avoid stockouts or overstocking situations.

- Customer loyalty programs: PayForce POS can integrate loyalty programs, enabling you to reward loyal customers and encourage repeat business. By offering incentives, discounts, or rewards, you can enhance customer loyalty and drive customer engagement.

- Easy integration with other systems: PayForce POS can seamlessly integrate with other business systems such as accounting software, inventory management systems, or customer relationship management (CRM) tools. This streamlines your business operations and improves efficiency by automating data synchronization and reducing manual data entry.

- Scalability: PayForce POS solutions are designed to cater to businesses of various sizes, from small businesses to large enterprises. Whether you operate a single store or multiple locations, PayForce POS can scale to meet your business requirements.

- Dedicated customer support: PayForce provides dedicated customer support to assist you with any technical issues, inquiries, or concerns related to their POS solutions. Their customer support team is available to provide guidance and resolve any issues you may encounter, ensuring smooth operation of your payment system.

These features and benefits make PayForce POS a valuable tool for businesses looking to streamline their payment processes, enhance customer experiences, and drive business growth.

FAQS

How much does Payforce charge per transaction?

Payforce charges transaction fees based on the type of transaction. The charges include withdrawals, deposits, airtime top-up, bill payments, and other transactions. The specific fees for each transaction type may vary, and it is recommended to refer to the latest fee structure provided by Payforce or contact their customer support for accurate and up-to-date information.

How much does POS charge per transaction?

The charges for POS transactions can vary depending on the service provider and the type of transaction. Different POS providers may have different fee structures, including fixed transaction fees or a percentage of the transaction amount. It is best to check with Payforce or your specific POS provider for the exact charges associated with each transaction.

How do I become a Payforce agent?

To become a Payforce agent, you can visit their official website or contact their customer support to inquire about the agent registration process. Payforce may have specific requirements and criteria that need to be met to become an agent. This can include having a registered business, providing necessary documentation, and undergoing a verification process.

Is Payforce a bank?

No, Payforce is not a bank. It is a financial technology company that provides payment solutions and services, including POS terminals and other digital payment solutions. Payforce collaborates with various banks and financial institutions to facilitate secure and convenient payment transactions.

Who is the owner of PayForce?

The ownership structure of Payforce is neobank FairMoney

Conclusion

In conclusion, obtaining a PayForce POS offers numerous benefits for businesses, allowing them to accept payments conveniently and securely. By understanding the charges, daily limits, and pricing associated with PayForce POS, businesses can make informed decisions and manage their transactions effectively.

The availability of a dedicated customer care number and the office address provides assurance that support and assistance are readily accessible when needed. With PayForce POS, businesses can enhance their payment capabilities, streamline operations, and provide a seamless experience for their customers.