In Nigeria, there are a number of loan apps that offer small loans of N10,000, N20,00

0, and N30,000. These loans can be a great way to get quick cash to cover unexpected expenses, such as medical bills, car repairs, or utility bills.

However, it is important to choose the right loan app when you are looking for a small loan. Some loan apps have high-interest rates and fees, which can make it difficult to repay the loan.

In this article, we will discuss the best loan apps for N10,000, N20,000, and N30,000 Naira loans in Nigeria. We will also provide some tips on how to choose the right loan app for your needs.

Read Also: How Many Jobs Are Available in Basic Industries?

Requirement For Loans From Loan Apps

When considering loans from various loan apps, it’s essential to understand the common requirements that borrowers typically need to meet. While specific requirements may vary slightly from one app to another, here’s a comprehensive overview of the general requirements for obtaining loans from loan apps in Nigeria:

- Age Eligibility:

- Most loan apps require borrowers to be within a certain age range, often between 18 and 60 years old. Some apps may have variations in this range.

- Residency:

- Borrowers typically need to be Nigerian citizens or legal residents with a valid means of identification, such as a national ID card, voter’s card, or international passport.

- Valid Bank Account:

- A functional and active bank account is a fundamental requirement. This is where the loan funds will be disbursed and from which repayments will be deducted.

- Smartphone and App Installation:

- As loan apps operate through mobile applications, borrowers need a smartphone to download and install the app from the relevant app store (Google Play Store or Apple App Store).

- Email Address and Phone Number:

- Loan apps require an email address and a valid phone number for communication and verification purposes. These details are used to send loan notifications and updates.

- Credit History:

- While some loan apps focus on providing loans without a credit check, others may consider your credit history to assess your creditworthiness. Having a positive credit history can improve your chances of loan approval.

- Source of Income:

- Many loan apps require borrowers to have a stable source of income. This could include salary, business income, or other verifiable means of earning money.

- Personal Information:

- Borrowers are typically required to provide personal details such as their full name, date of birth, gender, and address.

- KYC Documentation:

- Know Your Customer (KYC) documentation is commonly required. This includes submitting scanned copies or clear images of official identification documents like your national ID card, voter’s card, or international passport.

- Bank Verification Number (BVN):

- Some loan apps may require your BVN for identity verification and to link your loan account to your bank account.

- Selfie or Video Verification:

- Certain loan apps may require borrowers to take a selfie or a short video during the application process for additional verification.

It’s important to note that meeting these requirements doesn’t guarantee loan approval. Loan apps evaluate each application individually based on factors like creditworthiness, income, and repayment history. Always ensure that you provide accurate information and read the terms and conditions of the loan app before proceeding.

List of Best Loan Apps for N10,000, N20,000, N30,000, N50,000, N100,000 Loans in Nigeria

If you’re in need of a small loan in Nigeria, there are several loan apps that can help you borrow amounts ranging from N10,000 to N30,000. Here are some of the best loan apps in Nigeria that offer small loan amounts:

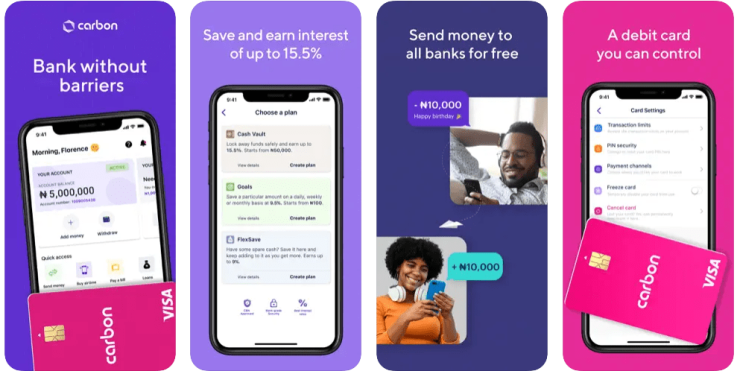

- Carbon (Formerly Paylater): Carbon is one of the most popular loan apps in Nigeria, offering instant loans with flexible repayment options. The app also provides a variety of financial services, including bill payments and investments. With loan amounts ranging from N2,500 to N1,000,000, Carbon is a convenient choice for small loans.

- FairMoney: FairMoney offers quick loans to individuals with minimal documentation. The app focuses on providing transparent and competitive interest rates to its users. With loan amounts ranging from N2,500 to N500,000, FairMoney is a reliable option for small loans.

- Branch: Branch provides accessible loans and also includes a feature to help users manage their money effectively. The app assesses creditworthiness through smartphone data and offers loans accordingly. With loan amounts ranging from N1,000 to N200,000, Branch is a user-friendly choice for small loans.

- PalmCredit: PalmCredit offers short-term loans to individuals, allowing them to borrow money and build a credit history. The app also provides users with a credit score to help improve financial credibility. With loan amounts of up to N100,000, PalmCredit is a convenient option for small loans.

- Aella Credit: Aella Credit aims to provide financial inclusion by offering loans to individuals, including those without a traditional credit history. With loan amounts ranging from N1,500 to N700,000, Aella Credit is a reliable option for small loans.

These loan apps offer a convenient and hassle-free way to borrow small loan amounts in Nigeria. Whether you need N10,000, N20,000, or N30,000, these apps can help you meet your financial needs. Just remember to carefully consider the interest rates and repayment terms before taking out a loan to ensure you can comfortably repay it on time.

FAQS

Which loan app can borrow me 30k?

Several loan apps in Nigeria offer loans of 30,000 Naira. Some options include Carbon, FairMoney, Branch, Aella Credit, and PalmCredit.

Which loan app is the sure best in Nigeria?

The “best” loan app can vary depending on individual preferences and needs. Some popular and reputable loan apps in Nigeria include Carbon, FairMoney, Branch, and Renmoney. It’s advisable to research and compare their terms, interest rates, and user reviews before choosing the one that suits you best.

Which loan app can give up to 300k?

Loan apps like Carbon, FairMoney, Renmoney, and Kiakia offer higher loan amounts, with some providing loans of up to 300,000 Naira. Eligibility for such amounts depends on factors like your creditworthiness, repayment history, and other criteria.

Which app gives a loan instantly?

Loan apps like Carbon, FairMoney, Branch, and PalmCredit are known for offering relatively quick loan approvals and disbursements. However, the speed of loan disbursement may vary based on factors such as verification processes and the completeness of your application.

How can I get an instant loan in 5 minutes in Nigeria?

To get an instant loan in 5 minutes in Nigeria, follow these steps:

- Download and install a reputable loan app like Carbon, FairMoney, or Branch.

- Register an account and complete the required personal and financial information.

- Submit the necessary documents, such as ID and proof of income.

- Apply for the desired loan amount.

- If approved, the loan amount will be disbursed to your bank account within a few minutes.

Remember, while these loan apps offer speed and convenience, it’s crucial to read and understand the terms, interest rates, and repayment schedules before proceeding. Responsible borrowing ensures a positive and manageable borrowing experience.

Conclusion

The digital age has ushered in a new era of financial empowerment, where smartphones and apps serve as gateways to timely financial relief. These loan apps have revolutionized the borrowing experience, offering streamlined application processes, swift approvals, and rapid disbursements. The convenience of accessing funds within the comfort of one’s digital space aligns seamlessly with the fast-paced nature of modern life.