Life is full of surprises, and sometimes we need money right away. But what if there was a way to get a loan instantly, without all the usual hassles? Well, in Nigeria, there are special apps that can help you do just that – get a loan immediately when you need it the most. These apps have made borrowing money easier and faster than ever before.

In this article, we’re going to explore the world of instant loans in Nigeria and introduce you to the top apps that can provide you with money in a snap. Whether it’s an unexpected expense, a sudden opportunity, or an urgent bill, these apps are here to help you get the funds you need right when you need them.

How to Get Instant Loan in Nigeria

Getting an instant loan in Nigeria has become more convenient and accessible than ever before, thanks to the emergence of various fintech platforms and lending apps. Whether you’re facing a financial emergency or need some extra funds for personal or business purposes, the process of obtaining an instant loan can be simplified into a few comprehensive steps:

- Research and Choose a Reliable Lending Platform: Start by researching the different lending platforms available in Nigeria. Look for reputable fintech companies that offer instant loan services. Read user reviews, check their terms and conditions, interest rates, and loan repayment options. Some popular lending platforms in Nigeria include Paylater (Carbon), Branch, FairMoney, QuickCheck, Renmoney, and Palmcredit.

- Download the App or Visit the Website: Once you’ve identified a suitable lending platform, download their mobile app from your device’s app store or visit their official website.

- Register and Create an Account: Open the app and follow the registration process. You’ll need to provide your personal information, including your name, phone number, email address, and sometimes your BVN (Bank Verification Number) for identity verification.

- Provide Required Documentation: Depending on the platform’s requirements, you may need to submit additional documentation, such as a valid ID (driver’s license, national ID card, or international passport) and a utility bill for address verification.

- Complete KYC (Know Your Customer) Verification: Many lending platforms require you to complete a KYC process. This may involve taking a selfie, submitting a photo of your ID, and providing additional information about your financial status.

- Submit Loan Application: Once your account is set up and verified, you can apply for a loan by entering the desired loan amount and selecting the repayment duration. Some platforms may also ask you to provide reasons for needing the loan.

- Wait for Approval: After submitting your loan application, the lending platform will review your information and assess your creditworthiness. This process usually takes a short period, often minutes to a few hours.

- Loan Approval and Disbursement: If your loan application is approved, you will receive a notification. The loan amount will be disbursed directly into your linked bank account or mobile wallet.

- Repayment: Keep track of your loan repayment date and ensure you have sufficient funds in your account to cover the repayment. Most lending platforms offer multiple repayment options, including bank transfer, debit card, or mobile wallet.

- Build Your Creditworthiness: Successfully repaying your instant loans on time can help you build a positive credit history with the lending platform. This can increase your chances of getting larger loan amounts and better terms in the future.

It’s important to note that while instant loans offer quick access to funds, responsible borrowing, and timely repayment are crucial to maintaining your financial health. Always read and understand the terms and conditions of the loan, including interest rates and any applicable fees.

Which App Gives Loan Immediately in Nigeria?

Obtaining a loan immediately in Nigeria has become increasingly accessible through various mobile apps and online platforms. These lending apps provide quick and convenient solutions to address urgent financial needs. Here is a comprehensive list of some of the popular instant loan apps in Nigeria and an overview of their features:

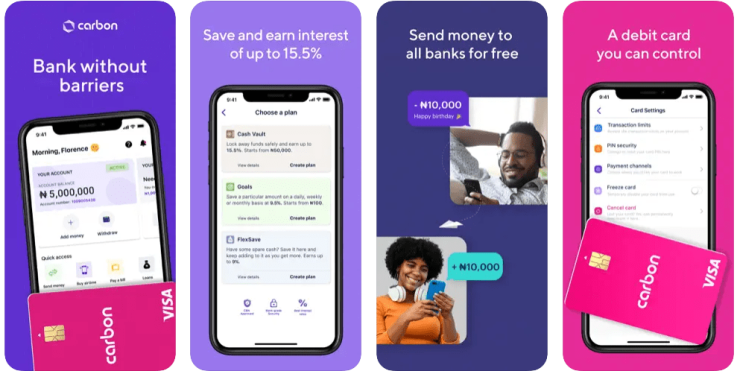

- Carbon (formerly Paylater): Carbon, formerly known as Paylater, is one of the pioneering instant loan apps in Nigeria. It offers short-term loans to individuals and small businesses. Users can apply for loans up to N500,000 and receive funds in their bank account within minutes of approval. Carbon also provides other financial services, such as bill payments and investment opportunities.

- Branch: The branch provides instant loans to Nigerians without requiring collateral. The app evaluates applicants’ creditworthiness using data from their mobile phones and offers loans up to N200,000. Repayment terms are flexible, and users can also earn rewards by referring friends to the app.

- FairMoney: FairMoney offers instant loans to individuals in Nigeria. It uses data from users’ phones to assess creditworthiness and determine loan eligibility. Users can apply for loans up to N500,000, and funds are typically disbursed within minutes. FairMoney also offers a feature that allows users to pay bills and recharge airtime.

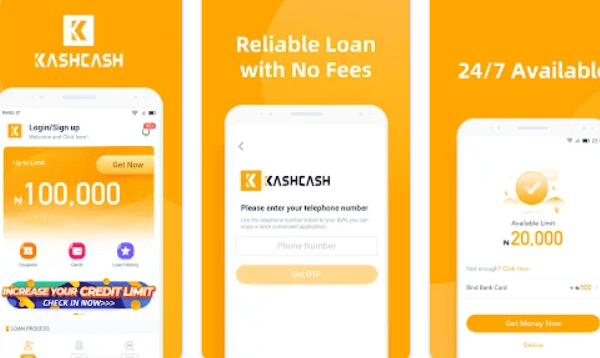

- Palmcredit: Palmcredit offers instant loans to individuals in Nigeria, with loan amounts ranging from N2,000 to N100,000. The app uses an artificial intelligence-driven credit scoring system to evaluate applicants. Successful loan applicants can receive funds directly into their bank accounts.

- Renmoney: Renmoney is a fintech platform that provides loans, savings, and investment solutions. While it doesn’t offer instant loans in the same way as other apps, its loan application process is relatively fast, and users can receive loan approvals within 24 hours. Renmoney offers larger loan amounts compared to some other apps.

- QuickCheck: QuickCheck offers instant loans of up to N500,000 to Nigerians. The app assesses applicants’ creditworthiness using alternative data sources and offers competitive interest rates. QuickCheck is committed to transparency and provides users with detailed information about their loan terms.

- KwikMoney (now Migo): KwikMoney, now rebranded as Migo offers instant loans to individuals and small businesses. Users can access loans of up to N500,000 with flexible repayment terms. Migo’s lending model evaluates users’ digital footprints to determine their creditworthiness.

- Aella Credit: Aella Credit offers instant loans to employees in Nigeria through partnerships with employers. The app provides access to loans based on users’ employment history and earnings. Aella Credit aims to improve financial inclusion and help users build credit scores.

These instant loan apps have significantly simplified the borrowing process in Nigeria, offering quick access to funds without the need for collateral or extensive paperwork. However, users need to borrow responsibly and ensure they can repay the loans within the specified time frame to avoid accumulating debt.

Read Also: Palmcredit Customer Care WhatsApp Number, Phone Number, Email address, and Office Address

FAQS

What app can borrow money instantly in Nigeria?

Several reliable instant loan apps in Nigeria can provide you with funds quickly. Some of the popular ones include Carbon (formerly Paylater), FairMoney, Branch, QuickCheck, and Palmcredit.

Which app can give me a loan immediately?

If you’re looking for an app that can give you a loan immediately, consider trying out platforms like Branch, FairMoney, or Carbon. These apps are known for their quick approval and disbursement processes.

Where can I borrow money urgently in Nigeria?

In Nigeria, you can borrow money urgently through various instant loan apps such as Branch, FairMoney, Carbon, and QuickCheck. These apps are designed to provide fast access to funds when you need them urgently.

Which loan app is the sure best in Nigeria?

The “best” loan app can vary depending on your specific needs and preferences. However, Carbon (Paylater) and FairMoney are widely recognized for their user-friendly interfaces, quick approval, and competitive interest rates. It’s recommended to research and compare multiple apps before making a decision.

What are the fake loan apps in Nigeria?

While there are many legitimate loan apps in Nigeria, there have also been reports of fake or fraudulent apps. To avoid falling victim to such scams, it’s essential to stick to well-known and reputable platforms like Carbon, FairMoney, Branch, and QuickCheck. Always verify the app’s credibility and read reviews before proceeding.

Remember, when using instant loan apps, ensure you understand the terms, interest rates, and repayment schedules. Responsible borrowing is key to managing your finances effectively and avoiding unnecessary debt.

Conclusion

Remember, instant loans can be a valuable tool in your financial toolkit, providing timely assistance when unexpected expenses arise. By choosing the right app that aligns with your needs and preferences, you can confidently navigate financial challenges and secure the funds you need, precisely when you need them.