In today’s digital age, loan apps have become increasingly popular in Nigeria for their convenience and accessibility. But what about those who don’t have a bank verification number (BVN)? Are there any loan apps that can be used without a BVN?

In this blog post, we will explore the different loan apps available in Nigeria that do not require a BVN to access loans. We will discuss the advantages and disadvantages of each, and look at the eligibility requirements for each app. We will also look at how to choose the best loan app for you.

FairMoney

FairMoney is a loan app that offers fast loans to Nigerians without requiring a Bank Verification Number (BVN). It’s a simple app that is easy to use, and the loans can be processed within minutes.

All you need to do is download the app from the Google Play Store and create an account. Once you have an account, you can apply for a loan and receive funds directly to your bank account. FairMoney offers loans up to ₦500,000, and the repayment period ranges from 61 days to 180 days.

The interest rate varies depending on the loan amount and repayment period, but it starts from as low as 10% per month. FairMoney also offers a referral program where you can earn ₦500 for each friend you invite to the app. Overall, FairMoney is an excellent option for anyone who needs a quick loan without the hassle of providing a BVN.

Quickteller

Another loan app without BVN in Nigeria is Quickteller. It’s a popular platform that offers more than just loan services. Users can perform a wide range of transactions, such as paying bills, airtime top-ups, and making donations.

To apply for a loan on Quickteller, you don’t need a BVN. However, you must have a bank account, be employed, and have a regular source of income. Quickteller offers loans up to ₦100,000 with repayment periods ranging from 14 days to 6 months.

To apply for a loan, download the Quickteller app, and create an account. Provide the necessary information and follow the application process. You’ll receive an instant decision on your loan application, and if approved, your funds will be disbursed into your account within minutes.

Read Also: Top 5 Fastest Growing Businesses to Start in Nigeria Right Now

One downside of Quickteller is its high-interest rates.

The platform charges between 2.5% to 15% on loans, depending on the amount borrowed and the repayment period. However, its convenient features make it a reliable option for those who need quick cash.

Kwikmoney

Kwikmoney is another popular loan app in Nigeria that provides loans without requiring BVN. This app offers instant loans of up to ₦100,000 to its users. However, before you can access loans on Kwikmoney, you must first create an account and apply for a loan.

To apply for a loan on Kwikmoney, you will need to provide basic information such as your name, phone number, and employment status. Once your loan application is approved, the funds will be disbursed to your account within a few minutes.

Kwikmoney also offers an affordable interest rate of 5% on its loans, which makes it an attractive option for borrowers looking for a low-cost loan. The repayment terms on Kwikmoney range from 14 days to 6 months, depending on the loan amount.

Like most loan apps in Nigeria, Kwikmoney has a credit scoring system that assesses the creditworthiness of borrowers before granting them loans. Therefore, it is essential to maintain a good credit history to increase your chances of accessing higher loan amounts on Kwikmoney.

Paylater

Paylater is one of the most popular loan apps in Nigeria that doesn’t require a BVN. The app offers instant loans ranging from ₦2,500 to ₦500,000 to its users. The application process is fast and easy. You can apply for a loan using the Paylater app, and the app will process your loan within a few minutes.

To apply for a loan on Paylater, you will need to download the app from the app store, sign up and fill out the application form. The app requires your personal details, such as your name, phone number, and email address. After submitting your application, Paylater will check your credit score and determine your eligibility for a loan.

The app also provides its users with a repayment plan, which shows the amount due, the due date, and the payment channel. The payment channel includes your debit card, direct bank transfer, or USSD transfer. Paylater’s interest rates start at 5%, and the app charges a processing fee on every loan.

The Paylater app is an excellent option for people who need a loan quickly without a BVN. The app is available for download on the app store, and it offers a convenient and fast loan application process. Paylater also provides its users with flexible repayment options and low-interest rates. If you need a loan quickly without a BVN, consider using Paylater.

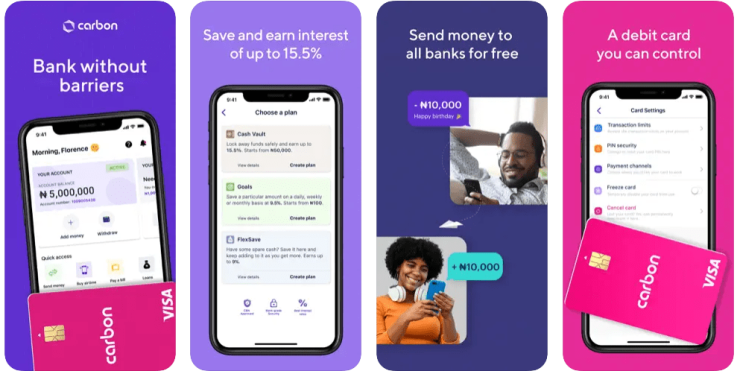

Carbon

Carbon is another top loan app that is known for its innovative approach to lending. Previously known as Paylater, Carbon has provided financial solutions to thousands of Nigerians since it launched in 2016.

One unique feature of Carbon is its focus on the creation of financial products that cater to the needs of underserved customers. This has seen the company become a preferred choice for people who have been previously overlooked by traditional lending institutions.

Carbon’s loan offerings come with flexible repayment plans, which makes them appealing to many Nigerians. Whether you’re looking for a short-term loan or a longer-term finance solution, Carbon has got you covered.

Another advantage of using Carbon is that the loan application process is quick and straightforward. With the app, you can complete the application process in a matter of minutes, without needing to visit any physical location.

Like other loan apps on this list, Carbon does not require a BVN for loan approval. However, users will need to provide other relevant details to verify their identity and creditworthiness.

Overall, Carbon is a great loan app that you can trust to provide you with financial assistance when you need it. With flexible repayment plans and user-friendly loan application processes, Carbon is a reliable and accessible option for anyone seeking financial solutions in Nigeria.

FAQS

What app lends the most money?

There are several apps that offer high loan amounts, but the specific amount may vary depending on factors such as your creditworthiness, financial history, and other factors. Some popular loan apps that offer high loan amounts in the United States include SoFi, LightStream, and Upstart.

Which loan app gives the highest loan in Nigeria?

The maximum loan amount offered by loan apps in Nigeria may vary depending on the specific app and your creditworthiness. However, some loan apps that offer high loan amounts in Nigeria include Carbon, FairMoney, and RenMoney.

How much can FairMoney borrow me?

The loan amount that you can borrow from FairMoney may vary depending on your creditworthiness, financial history, and other factors. However, FairMoney offers loans ranging from 1,500 to 500,000 naira for a duration of 4 to 26 weeks.

Which loan app gives 50000 instantly?

There are several loan apps in Nigeria that offer instant loans up to 50,000 naira, including Carbon, PalmCredit, and QuickCheck.

Where to loan 300k?

You may be able to borrow 300,000 naira from loan apps in Nigeria such as Carbon, FairMoney, and RenMoney. However, the specific loan amount and terms may vary depending on your creditworthiness and other factors. Additionally, you may also want to explore other options such as traditional banks and credit unions to ensure that you find the best loan option for your needs.

Conclusion

While the requirement for a Bank Verification Number (BVN) is quite important for security reasons, there are still some loan apps in Nigeria that do not require it. FairMoney, Quickteller, Kwikmoney, Paylater, and Carbon are some of the popular loan apps that do not require BVN.

However, it’s important to note that some of these loan apps may require other forms of verification or collateral. Always ensure you read and understand the terms and conditions before applying for any loan. It’s also important to borrow responsibly and repay on time to avoid penalties and additional charges. Overall, with the numerous loan options available, borrowers in Nigeria can now access loans more easily, even without a BVN.