Kuda and Palmpay have been around for a while in Nigeria providing financial services to us, and saving us from the stress and bad customer service most of the traditional banks in Nigeria make us go through.

However, if you have been battling the thought to decide on which of Palmpay and Kuda is better, I will like to tell you, you are not alone and there are thousands of people out there, wanting to know which is better.

In this article, we will take a closer look at Palmpay and Kuda to know which is best among the two, so let’s get started.

About Kuda

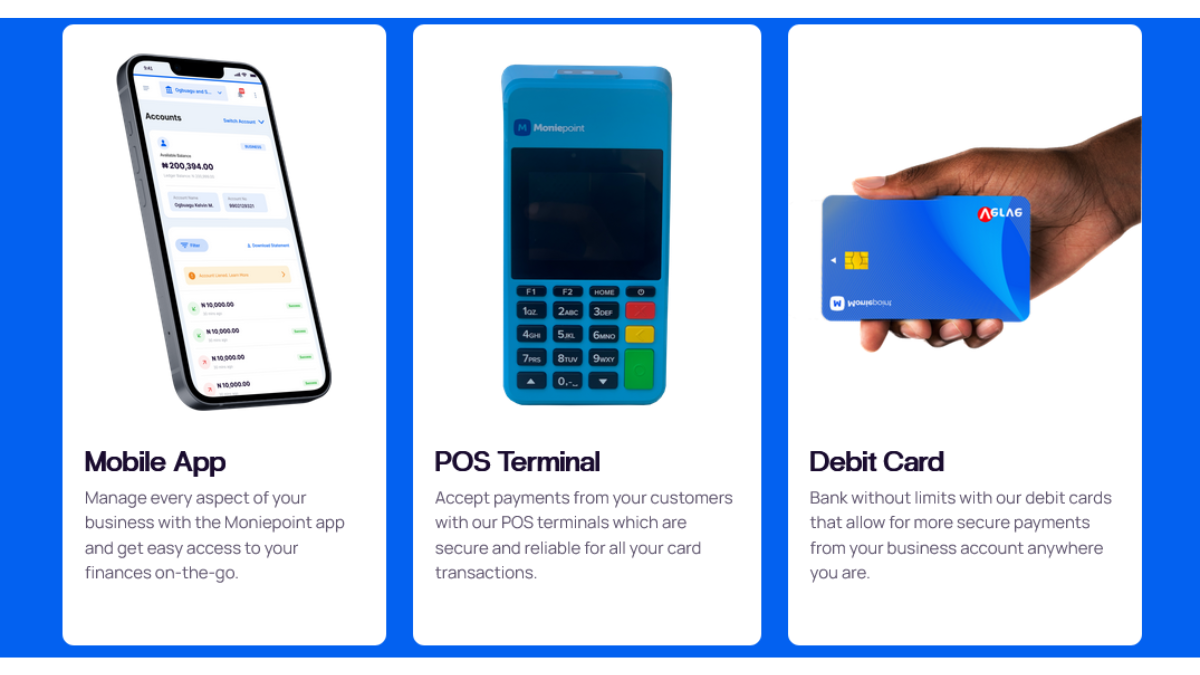

Kuda is a Nigerian digital bank that offers a range of banking services through its mobile app. It was founded in 2018 to provide a seamless banking experience to Nigerians through a combination of technology and customer-centric services.

One of the standout features of Kuda is its ability to open an account in less than five minutes, with no paperwork or physical presence required. Users can download the app, provide their details, and instantly gain access to a range of banking services. This process is particularly appealing to the growing number of Nigerians who are seeking to access financial services without the bureaucracy and inconvenience of traditional banks.

Kuda offers a range of services including savings accounts, loans, and bill payments. Savings accounts come with competitive interest rates, which can be earned daily. This is particularly appealing to users who are looking to save their money securely and conveniently. In addition, Kuda offers instant loans to users, which can be accessed through the app, with no collateral or paperwork required.

One of the key strengths of Kuda is its user-friendly interface, which is easy to navigate and understand. The app is designed to provide a seamless user experience, with features such as automatic budgeting and expense tracking. Users can also set up recurring payments for bills and other expenses, which can help them stay on top of their financial obligations.

Despite its numerous strengths, Kuda also has some downsides. For example, the app is only available to Nigerians with a valid BVN (Bank Verification Number), which may limit its appeal to non-Nigerians or those without a BVN. Additionally, while Kuda provides competitive interest rates on savings, these rates may not be as high as those offered by some traditional banks.

Features And Downside Kuda

Below are some of the key features and downsides of Kuda:

Features:

- Instant account opening: Kuda allows customers to open an account instantly without the need for paperwork or physical presence. This feature makes it easy for users to access banking services from anywhere and at any time.

- Instant loans: Kuda offers instant loans to customers with no collateral or paperwork required. Customers can access the loans through the app, and the funds are disbursed immediately.

- Competitive interest rates: Kuda provides competitive interest rates on savings, which are calculated daily. This feature is particularly attractive to users who are looking to save their money securely and conveniently.

- Bill payments: Kuda allows customers to make bill payments for utilities, cable TV, internet services, and other expenses through the app. This feature helps customers stay on top of their financial obligations and avoid late payment fees.

- Automatic budgeting: The app comes with a budgeting feature that helps customers manage their expenses and keep track of their spending. The feature categorizes expenses and helps customers identify areas where they can cut back on spending.

Downsides:

- Limited availability: Kuda is only available to Nigerians with a valid BVN (Bank Verification Number), which may limit its appeal to non-Nigerians or those without a BVN.

- Limited branch network: As a digital bank, Kuda does not have a physical branch network, which may be inconvenient for users who prefer to bank in person.

- Limited services: While Kuda offers a range of banking services, it may not offer the same breadth of services as traditional banks. For example, it may not offer investment or wealth management services.

- Limited customer support: Kuda’s customer support is primarily provided through the app, and some users have reported difficulties in getting prompt and satisfactory responses to their inquiries.

About Palmpay

Palmpay is a financial technology company that was founded in 2019. The company is focused on providing innovative financial solutions to individuals and businesses in Nigeria. Palmpay’s mission is to make financial services accessible to everyone, regardless of their location or income level.

At Palmpay, they understand the importance of convenient, secure, and fast financial services, and have designed their products and services to meet these needs. Palmpay offers a range of financial solutions including payments, investments, loans, and more.

Palmpay has made significant strides in the Nigerian fintech industry, thanks to its user-friendly platform and cutting-edge technology. With its advanced security features, users can be sure that their transactions are safe and secure. Additionally, Palmpay’s customer support team is always on hand to assist whenever it is needed.

Palmpay has also formed strategic partnerships with leading financial institutions, enabling it to provide a wide range of financial services to its users. The company’s innovative approach has helped it gain a strong foothold in the market, and it continues to grow at an impressive rate.

Features And Downsides

Palmpay, a mobile payment app, has several features that make it a popular choice among Nigerian users. Here are some of its key features:

- Easy and Fast Transactions: Palmpay enables users to send and receive money easily and quickly without the need for any bank account. The app is user-friendly and enables transactions to be carried out in a matter of seconds.

- Security: Palmpay is highly secure, protecting users’ transactions and data with industry-standard security protocols. Users can also secure their accounts with biometric authentication.

- Bill Payments: Palmpay allows users to pay bills such as electricity, water, and internet bills. Users can also purchase airtime and data bundles directly from the app.

- Investments: Palmpay offers users an investment feature called “Palmsave” which enables them to save and earn interest on their savings.

However, like every other app, Palmpay has some downsides, including:

- Limited Availability: Palmpay is currently only available in Nigeria and is not accessible in other countries. This limits its usability for people who travel frequently or live outside of Nigeria.

- Customer Service: Palmpay’s customer service is sometimes slow to respond to users’ queries, which can be frustrating for users who need immediate assistance.

- Transaction Limits: Palmpay has transaction limits that are lower than those of other payment apps, which can be inconvenient for users who need to make large transactions.

- Network Issues: Palmpay can be slow to respond when there is a poor network connection, which can cause delays in transactions.

Despite its downsides, Palmpay remains a popular mobile payment app in Nigeria due to its ease of use, security, and ability to handle bill payments and investments.

Read Also: Palmpay vs Opay: Which Is The Best?

Kuda vs Palmpay: Which Is Better?

Both Kuda and Palmpay offer similar services in the Nigerian fintech space, but there are some notable differences between the two that may make one preferable to certain users over the other.

One of the key advantages of Kuda is that it offers free transfers, withdrawals, and account maintenance with no hidden charges. It also has a more straightforward and user-friendly interface, making it easy for users to navigate and access their accounts.

On the other hand, Palmpay offers a wider range of services, including bill payments, airtime and data top-ups, and investments in mutual funds. It also has a rewards program that offers cashback on transactions, which can be appealing to users who make frequent transactions.

In terms of security, both platforms employ industry-standard security protocols to protect users’ funds and personal information.

However, there are some downsides to both platforms. Kuda has a relatively limited customer support system, which can make it difficult for users to get help when needed. Palmpay, on the other hand, has been criticized for its high fees on some transactions, which can be a deterrent for some users.

Based on the comparison between Kuda and PalmPay, it is difficult to give a straightforward answer on which is the best. Both mobile payment platforms have their unique features, advantages, and disadvantages. Therefore, it ultimately depends on the individual’s preferences and needs.

If someone is looking for a more straightforward and user-friendly mobile payment platform, PalmPay may be the better option. On the other hand, if someone values the convenience of opening a bank account from their mobile device and having a higher transaction limit, Kuda may be the better option.

FAQS

Which bank is better than PalmPay?

Answer: PalmPay is not a bank, it is a mobile payment platform. However, several banks offer mobile banking services that can be compared to PalmPay such as Access Bank’s “AccessMore” and GTBank’s “GTWorld”.

What bank is better than Kuda?

Answer: Kuda is a digital-only bank that offers unique services to its customers. While there are other digital banks like ALAT by Wema Bank, Rubies Bank, and V Bank, it is difficult to say which is better as it depends on individual preferences and needs.

Which one is better Kuda and OPay?

Answer: Kuda and OPay offer different services, Kuda is a digital-only bank while OPay is a mobile payment platform that also offers other services like ride-hailing and food delivery. It is not fair to compare the two as they cater to different needs.

Which bank owns PalmPay?

Answer: PalmPay is owned by Transsnet Financial, a joint venture between Transsion Holdings and NetEase, and is not owned by any bank.

Which is the number 1 best bank in Nigeria?

There are different opinions on the best bank in Nigeria, as it depends on factors such as customer service, accessibility, and product offerings. However, some of the top banks in Nigeria based on market share and customer satisfaction include Access Bank, First Bank, GTBank, and Zenith Bank.

Can I trust Kuda Bank?

Kuda Bank is a licensed and regulated financial institution by the Central Bank of Nigeria (CBN). As with any bank, it is important to do your own research and due diligence before using their services. However, Kuda Bank has received positive reviews for its user-friendly app and customer service.

Conclusion

In conclusion, the fintech industry in Nigeria has witnessed a significant boom in recent years with the emergence of innovative digital banking platforms such as Kuda, PalmPay, and OPay. These platforms have become popular among Nigerians for their user-friendly interfaces, affordability, and convenience.

Kuda stands out for its zero charges on transactions, no hidden fees, and ease of opening an account. PalmPay, on the other hand, offers its users access to a wide range of financial services and a cashback reward system. OPay, with its all-in-one app, provides its users with access to ride-hailing services, food delivery, and other essential services.

Choosing the best platform ultimately depends on individual preferences and needs. While Kuda may be the best choice for those looking for a completely free digital banking experience, PalmPay and OPay may be better suited for those looking for a wider range of financial and non-financial services.