Banks have gone online! Imagine being able to do all your banking stuff right from your phone or computer, without needing to rush to a physical bank. It’s like having your own personal bank in your pocket!

In this article, we’re going to introduce you to the top 15 online banks in Nigeria. These are the banks that have taken banking to a whole new level by using the power of the internet. They’re like the superheroes of the banking world, making things super easy and convenient for you.

Just like you use apps on your phone for different things, these online banks have their own special apps that let you do everything from checking your balance to sending money to your friends. They’re designed to make your life simpler and save you time.

1) V by VFD (Vbank)

Looking for a unique online banking experience in Nigeria? Look no further than V by VFD, also known as Vbank. Vbank offers a range of features that make it stand out among the competition. With Vbank, you can enjoy a completely digital banking experience, allowing you to access your funds and manage your accounts anytime, anywhere.

One of the key features of Vbank is its virtual cards. These virtual cards provide added security for online transactions, as they are not physically present and cannot be stolen. You can create multiple virtual cards for different purposes, such as online shopping or subscription services, and easily manage them through the Vbank app.

In addition to virtual cards, Vbank also offers a unique savings feature called the Flex Naira feature. With this feature, you can set aside a certain amount of money in a separate account, which earns interest while still being accessible to you. This allows you to save and grow your money without sacrificing liquidity.

With its user-friendly interface and innovative features, Vbank is definitely a top contender in the world of online banking in Nigeria. Whether you’re looking for a reliable savings account or a seamless online banking experience, Vbank has got you covered.

2) Kuda Bank

Kuda Bank, is the digital-only bank that is revolutionizing the way Nigerians manage their finances. Kuda Bank offers a seamless online banking experience with features that make it a top choice for individuals and businesses alike.

One of the standout features of Kuda Bank is its zero fees policy. That’s right, no monthly maintenance fees, no transaction fees, and no minimum balance requirements. This means you can keep more of your hard-earned money in your pocket. Plus, with Kuda Bank’s real-time notifications, you’ll never miss a transaction or an opportunity to save.

Another reason why Kuda Bank is gaining popularity is its commitment to customer service. Unlike traditional banks, Kuda Bank provides round-the-clock support, so you can reach out for help anytime you need it. Whether you have a question about a transaction or need assistance with setting up a savings goal, the friendly and knowledgeable customer support team at Kuda Bank is there to assist you.

With its user-friendly interface and innovative features, Kuda Bank is making banking easier, more accessible, and more convenient than ever before. Whether you’re a student looking to open your first bank account or an entrepreneur in need of a business banking solution, Kuda Bank has you covered. Experience the future of banking with Kuda Bank today.

Read Also: Which Banks Have the Best Network Service and Best Security in Nigeria?

3) ALAT by Wema Bank

ALAT by Wema Bank is a leading online bank in Nigeria that offers a range of innovative features and services. With ALAT, you can manage your finances conveniently and securely, right from your mobile phone or computer.

One of the standout features of ALAT is its unique virtual dollar card. This virtual card allows you to make online payments in foreign currency without the need for a physical card. It’s a great option for international transactions, as it offers a competitive exchange rate and eliminates the hassle of carrying cash or dealing with currency conversion.

ALAT also offers a robust savings feature called the Goal Savings account. With this feature, you can set financial goals and save towards them automatically. You can even earn up to 10% annual interest on your savings, making it a smart choice for anyone looking to grow their wealth.

Another notable feature of ALAT is its budgeting tool. With this tool, you can track your spending, set budget limits, and receive notifications when you exceed them. It’s a great way to stay on top of your finances and avoid overspending.

ALAT by Wema Bank is a top choice for online banking in Nigeria, thanks to its user-friendly interface, innovative features, and commitment to customer satisfaction. Whether you’re a tech-savvy individual or a small business owner, ALAT has the tools and resources you need to manage your finances effectively and efficiently. Start your online banking journey with ALAT today and experience banking at your fingertips.

4) Opay

OPay is one of the best online banks in Nigeria. It is a digital payment and financial services platform that offers a wide range of services, including money transfers, by allowing users to send and receive money quickly and easily to any bank account in Nigeria.

Also, OPay users can pay their utility bills, cable TV bills, and other bills with just a few taps on their phone.

Security is also a top priority at Opay. The bank uses the latest encryption technology to protect your sensitive information and ensures that your transactions are secure.

5) Palmpay

Are you tired of juggling multiple banking apps for different financial needs? Look no further than Palmpay, the all-in-one banking solution that simplifies your financial life. With Palmpay, you can access all your accounts and manage your finances from a single, user-friendly app.

Registration on Palmpay is super easy, as it only requires your phone number. Furthermore, once you sign up, you can start using your account within that same minute, even without you using your BVN. However, if you do not link your BVN to your Palmpay account, your transaction limit will be limited to just #50k per day.

With its commitment to convenience and comprehensive banking solutions, Palmpay is definitely a game-changer in the world of online banking in Nigeria. Simplify your financial life and experience the power of Palmpay today.

6) Eyowo

Eyowo is a unique online banking solution that brings convenience and flexibility to your financial life. With Eyowo, you can easily send and receive money, make payments, and even earn rewards, all from your mobile phone.

One of the standout features of Eyowo is its focus on financial inclusion. The platform allows anyone with a mobile phone to create an account and access banking services, regardless of their location or income level. This makes Eyowo a great option for individuals who may not have access to traditional banking services.

In addition to its accessibility, Eyowo also offers a range of features that enhance the overall banking experience. You can easily link your bank accounts and cards to your Eyowo account, making it easy to transfer funds and make payments. The platform also offers a virtual card that allows you to shop online securely.

Whether you’re a student, a small business owner, or someone who simply wants a convenient and accessible banking solution, Eyowo is definitely worth considering. Sign up today and experience the freedom and flexibility of banking with Eyowo.

7) Fundall

This innovative online bank offers a range of features that make it a top choice for individuals and businesses alike.

One of the standout features of Fundall is its focus on financial wellness. The platform provides tools and resources to help you track your spending, set savings goals, and even invest in mutual funds. With Fundall, you can gain a better understanding of your finances and make informed decisions about your money.

In addition to its financial wellness features, Fundall also offers a seamless online banking experience. You can easily transfer funds, make payments, and manage your accounts all in one place. Plus, with Fundall’s responsive customer support team, you can get help whenever you need it.

Whether you’re a freelancer, a small business owner, or someone who wants to take control of their finances, Fundall is definitely worth considering. Sign up today and experience the convenience and flexibility of online banking with Fundall.

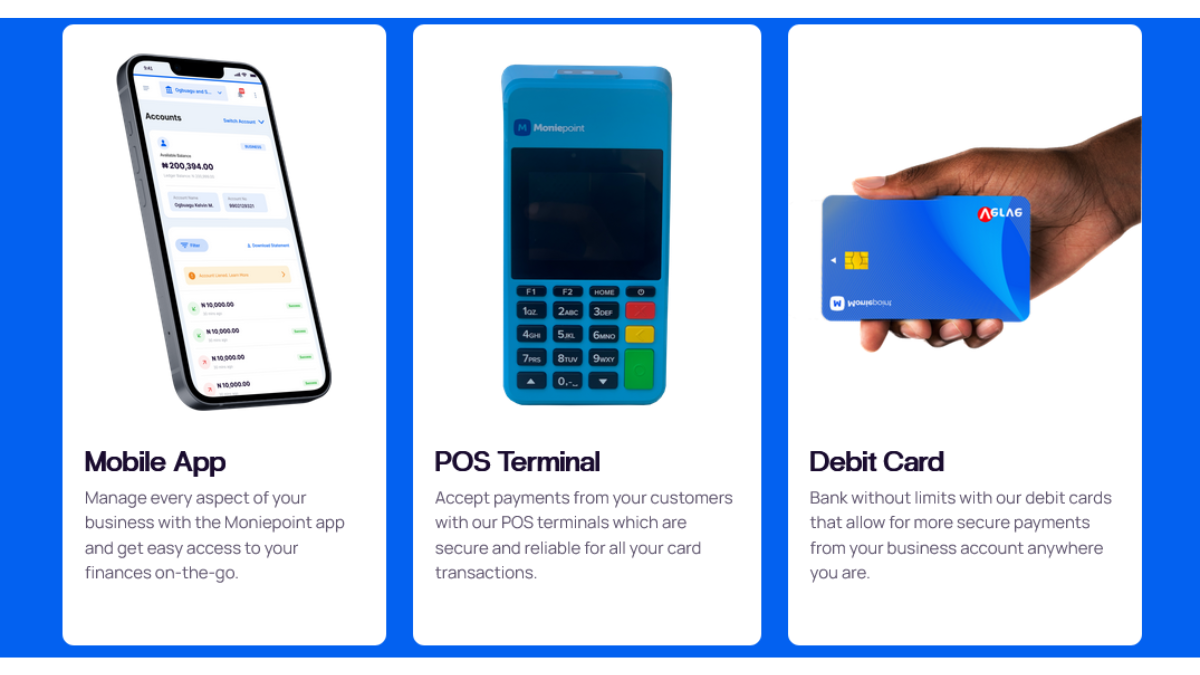

8) Moniepoint

One of the standout features of Moniepoint is its focus on financial empowerment. The platform offers tools and resources that help users understand their finances, set financial goals, and make informed decisions. Whether you’re a freelancer, a small business owner, or someone who wants to take control of your finances, Moniepoint has the resources to help you succeed.

In addition to its financial empowerment features, Moniepoint also offers a range of convenient banking services. From fund transfers to bill payments, you can easily manage your accounts and make transactions right from your mobile device.

If you’re looking for a digital bank that combines convenience, empowerment, and user-friendly features, Moniepoint is definitely worth considering.

9) Prospa

Prospa, an online banking solution designed specifically for small businesses in Nigeria. Prospa offers a range of features and services that make managing your finances easier than ever before.

One of the standout features of Prospa is its seamless integration with popular accounting software like QuickBooks and Xero. This means you can easily sync your Prospa account with your accounting software, saving you time and eliminating the need for manual data entry. With real-time updates, you’ll always have an accurate view of your business’s financial health.

Prospa also offers a range of business banking solutions, including business accounts, business loans, and invoice financing. Whether you need funds to expand your business or cash flow to cover expenses, Prospa has the resources to help you grow.

With its user-friendly interface and dedicated support team, Prospa is the go-to online bank for small businesses in Nigeria. Sign up today and take your business to new heights with Prospa.

10) Piggyvest

If you’re looking for an online bank that helps you save and invest your money, look no further than Piggyvest. This innovative platform offers a range of features and services that make it a top choice for individuals who want to grow their wealth.

One of the standout features of Piggyvest is its savings feature. With Piggyvest, you can set aside money regularly and earn interest on your savings. You can even set specific savings goals, such as a vacation or a down payment on a house, and track your progress along the way.

But Piggyvest is not just about saving money – it also offers investment opportunities. With Piggyvest, you can invest in various assets, such as stocks and cryptocurrencies, and potentially earn higher returns on your money.

In addition to its savings and investment features, Piggyvest also offers a range of convenient services, such as bill payments and fund transfers. You can easily manage your accounts and make transactions right from your mobile device.

If you’re ready to take control of your financial future and start saving and investing, Piggyvest is the online bank for you. Sign up today and start growing your wealth with Piggyvest.

11) Rubies

This online bank offers a range of features that make managing your finances easier and more enjoyable than ever before.

One of the standout features of Rubies is its commitment to financial education. The platform provides resources and tools that help users understand personal finance and make informed decisions. From budgeting tips to investment guides, Rubies empowers you to take control of your financial future.

Rubies also offers a unique rewards program that allows you to earn points for using the app. These points can be redeemed for a variety of rewards, such as cashback, gift cards, and exclusive discounts. It’s a great way to make the most of your banking experience.

With its user-friendly interface and innovative features, Rubies is definitely worth considering if you’re looking for a digital bank that goes the extra mile. Sign up today and experience the difference with Rubies.

12) Zuri

This innovative online bank in Nigeria offers a range of features that set it apart from the competition.

One of the standout features of Zuri is its emphasis on customization. With Zuri, you have the ability to personalize your banking experience, from customizing your debit card design to setting savings goals that align with your financial aspirations. This level of personalization allows you to take control of your finances and make banking a truly tailored experience.

But Zuri doesn’t stop at personalization – it also offers a seamless and user-friendly interface. With its intuitive mobile app, you can easily manage your accounts, make transactions, and track your spending all in one place. No more jumping between multiple apps or struggling with complex navigation.

Whether you’re a tech-savvy individual or a small business owner, Zuri has the tools and resources to help you succeed. Sign up today and experience the future of online banking with Zuri.

13) Mono

Mono offers a range of features and services that make managing your finances a breeze. With Mono, you can easily track your income and expenses, create invoices, and receive payments from clients. The platform even integrates with popular accounting software, making it easy to keep your financial records in order.

But Mono isn’t just about convenience – it’s also about empowerment. The platform provides resources and tools to help you grow your business and make informed financial decisions. From budgeting tips to business insights, Mono has everything you need to succeed.

Experience the power of digital banking tailored to freelancers and small businesses with Mono. Sign up today and take your business to the next level.

14) Polaris Bank Digital

This online banking platform combines the convenience of digital banking with the reliability and trust of a well-established bank.

Polaris Bank Digital offers a range of features and services that make managing your finances easier than ever before. From fund transfers to bill payments, you can easily handle all your banking needs right from your computer or mobile device. Plus, with its user-friendly interface and intuitive navigation, you’ll have no trouble navigating through your accounts and transactions.

Security is also a top priority at Polaris Bank Digital. The platform uses the latest encryption technology to protect your personal and financial information, ensuring that your transactions are secure.

Whether you’re a new customer or an existing customer looking to switch to online banking, Polaris Bank Digital is definitely worth considering. Experience the convenience and flexibility of digital banking with Polaris Bank Digital today.

15) Unity Bank Digital

Looking for a digital banking solution that offers both convenience and reliability? Look no further than Unity Bank Digital. This online banking platform provides a seamless banking experience with features that make managing your finances a breeze.

With Unity Bank Digital, you can easily access your accounts, transfer funds, and make payments right from your computer or mobile device. The user-friendly interface and intuitive navigation make it easy to navigate through your transactions and stay on top of your finances.

But it’s not just about convenience – Unity Bank Digital also prioritizes security. The platform uses advanced encryption technology to protect your personal and financial information, ensuring that your transactions are safe and secure.

Whether you’re a new customer or an existing customer looking to switch to digital banking, Unity Bank Digital is definitely worth considering. Experience the convenience and reliability of digital banking with Unity Bank Digital today.

FAQS

What are the 10 online banks approved by CBN?

The 10 online banks approved by the Central Bank of Nigeria (CBN) as of March 2023 are:

- Sofri

- Mint

- Piggyvest

- VFD

- Moniepoint

- FairMoney

- Carbon

- Kuda

- Eyowo

- Sparkle

What banks are similar to Kuda?

Kuda is a fully digital bank that offers a variety of features, including savings accounts, investment accounts, and debit cards. Some banks that are similar to Kuda include:

- V by VFD (Vbank)

- ALAT by Wema Bank

- Sparkle Digital Bank

- OneBank

- Eyowo

- Fundall

- Mintyn Digital Bank

- Prospa

- Piggyvest

- Rubies

Which banks are best for online banking?

The best banks for online banking in Nigeria depend on your individual needs and preferences. However, some of the most popular and highly rated online banks in Nigeria include:

- Kuda

- V by VFD (Vbank)

- ALAT by Wema Bank

- Sparkle Digital Bank

- OneBank

- Eyowo

- Fundall

- Mintyn Digital Bank

- Prospa

- Piggyvest

What is similar to Kuda app?

Some apps that are similar to the Kuda app include:

- V by VFD (Vbank) app

- ALAT by Wema Bank app

- Sparkle Digital Bank app

- OneBank app

- Eyowo app

- Fundall app

- Mintyn Digital Bank app

- Prospa app

- Piggyvest app

- Rubies app

Which other bank is like Opay?

Opay is a mobile money platform that offers a variety of financial services, including mobile money transfers, bill payments, and airtime top-ups. Some banks that are similar to Opay include:

- Paystack

- Flutterwave

- PalmPay

- Barter by Flutterwave

- V by VFD (Vbank)

- ALAT by Wema Bank

- Sparkle Digital Bank

- OneBank

- Eyowo

Conclusion

Beyond convenience, these online banks represent a bigger transformation. They are a testament to the spirit of innovation and progress that is sweeping through Nigeria’s financial landscape. They showcase the country’s readiness to embrace cutting-edge technology and adapt it to the needs of its people.